Gold Information: Tariff Uncertainty Sets off Gold Rally From one-Day Reduced

Content

That have trust in the united states’s economic stability at the listing lows, buyers dropping trust inside papers gold can begin bringing actual birth of your own material. Probably the globe’s biggest bullion banking companies might not have the fresh collection to cover this type of losses, that will push quick providers to pay for its ranking and you may include strength for the rally. Diversification does not make sure people investment production and will not get rid of the risk of losings. The fresh ensuing efficiency of every investment outcomes which may be generated as a result of allowance to gold try hypothetical in nature, might not reflect real funding results and they are not pledges of future performance. The country Gold Council as well as affiliates do not make sure or promise people calculations and you will models utilized in any hypothetical profiles or any effects because of these explore. Buyers would be to discuss the private issues making use of their compatible financing pros before you make people decision from any Functions or investments.

Price Projections

- The current environment recalls previous silver surges regarding the seventies and you may early 2000s, whenever economic suspicion and you may rising prices eroded confidence inside antique possessions.

- Now, it appears to be the newest Given is enthusiastic to stay that have inflating the new economy to quit the new poor of your own economic fall out — a life threatening tailwind to possess precious metals prices moving on.

- Of several analysts is actually contrasting the present day economy to this away from the newest 1970s through to the discount joined nearly ten years out of corrosive stagflation.

- To the drawback, $dos,900 (round top) aligns while the meantime assistance before $dos,885 (straight down restrict of the rising station).

- Gold’s attitude for 2025 remains robust, underpinned by the its dual part while the a secure refuge and you will a great proper asset.

The fresh yearlong rally from the cost of silver seems positioned to help you keep in the days in the future—it doesn’t matter how happens in Tuesday’s election. But really, one to brave commenter asked myself where We anticipate silver supposed if it can greatest within my expected target. And you will, when i answered which i questioned it may drop back to the newest $1,000 region he replied by the chiming inside the while the anyone else and you may telling myself I understand absolutely nothing regarding the silver or financial segments.

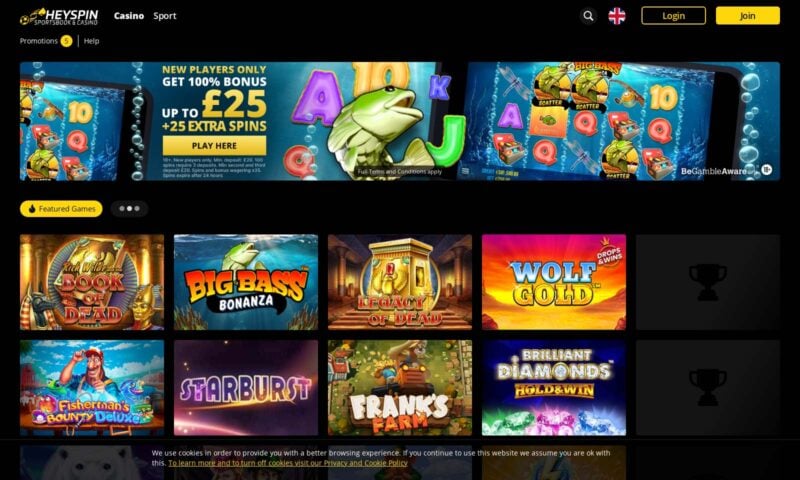

User reviews out of Gold Rally slot games

Benefits are already growing the silver speed predictions for the next long time. WGC wants central financial silver demand to help you flourish due to 2025 and you will beyond. For its part, https://happy-gambler.com/gowin-casino/ China has used silver to purchase quotas which suggests its gold binge is formal rules, echoing the brand new tip away from biggest financial institutions. Usually, periods from highest rising prices and you may geopolitical uncertainty provides constantly viewed silver perform highly, bringing an effective precedent on the latest rally. Comparing that it so you can past schedules, like the 70s and/or article-2008 financial crisis day and age, suggests comparable designs of individual trip to security.

Gold’s industry capitalization reached a different number from $29 trillion on the Thursday as a result of its rates jumped so you can an all-time high of $cuatro,357 for each oz. Silver pricing is upward biased, positioned to issue highest prices over the latest YTD most of $step 3,038. If people clear aforementioned, they might test $3,050 and $step three,a hundred data. It’s worth detailing that Relative Power Directory (RSI) is overbought. But the strength of one’s trend ideas your “really extreme” understanding was 80; which XAU/USD you’ll always trend highest. The united states economic docket will give a few study releases you to definitely might have an initial-long-term impact on Silver’s valuation.

Cash Rally now offers various ways to buy gold coins, gems, sale, and you can purpose citation. Your opportunity to profit away from a possible gold short squeeze try wholly dependent on your preparation now. Schiff and other analysts try pointing for the optimistic referring to the newest wall, suggesting silver’s inertia have a tendency to take it a lot higher, powered from the systemic short vendors.

But not, various other expanded-label issues and you can fashion will assist determine whether the new rally usually getting sustained. Ascending geopolitical tensions and you can growing macroeconomic imbalances features brought about strong to find momentum on the silver market, pushing cost so you can $cuatro,two hundred. Buyers try turning to silver because the an excellent hedge up against rising prices and you will because the protection from plan missteps and you will global instability. The brand new Russia-Ukraine battle intensifies, with episodes near Moscow and you will Kursk. Even with short-name money-taking, the general mindset to have gold remains optimistic because of solid principles and chronic global threats. Financial of America1 forecasts another higher to possess silver, expecting rates to-arrive $dos,eight hundred an ounce on the rear away from relaxed interest levels.

Even after not having nuts icons otherwise 100 percent free spins, the game now offers exciting gameplay which have an autoplay element, spread out icon, and you will a plus bullet. Featuring a new 3×step three layout and you can silver mining motif, Silver Rally demands participants so you can win big with icons including dynamite, silver bars, and bills. For the potential to win life-altering figures, that it slot is compatible with certain gadgets and you may claims a nice gaming experience. While you are advancements including a free of charge spins bonus bullet you may improve the game after that, Gold Rally stays a top selection for the individuals looking to excitement and you can huge wins. She told you rising silver costs are usually element of a standard flow one to drags down anything high-risk.

By going for gold, you’re also opting from the risks intrinsic inside the fiat money and you can protecting a future where your to find energy is actually your own personal in order to control. Such, a buck inside 1990 had more to find power than simply today, but an oz of silver features hired—otherwise enhanced—the to buy command over the same several months. The difference between the brand new silver quote price and also the silver query price is known as quote-query spread, that may are different according to the newest also provide and request in the the marketplace, purchase dimensions, along with other issues. Even with lingering QT, the new Given has grown its holdings of long-name U.S. This task decorative mirrors the effects of decimal reducing, helping remain rates artificially low.

Evident verdict on the Gold Rally casino slot games

Treasury production flower on the Wednesday as the people awaited new home conversion study and reviewed a few weak monetary indications, in addition to unsatisfying individual rely on and soft to purchase professionals’ research. This type of blended signals include complexity so you can silver’s mentality, as the reducing economic development you will reignite safe-refuge consult. Away from the latter bonuses, others is as a result of standard gameplay. In terms of big victories, you could potentially only complete the complete 3×3 grid for the gold measure spread out icons. Player’s earn the greatest count that the Silver Rally Slot offers once they strike the ‘GR’ logos.

Because the inventor from Gold Predictors, the guy guides a group getting complex business statistics, quantitative research, and refined gold and silver coins trading procedures. The newest Bitcoin-to-Silver ratio graph lower than reveals a stable uptrend since the 2012, showing solid optimistic energy to possess Bitcoin. Yet not, a switch opposition has shaped near the 40 top, where the ratio might have been merging inside the a rigid assortment. So it integration first started while the gold costs increased and bankrupt above the critical $3,500 draw.

- It’s surged more twenty eight% year-to-date, striking a series of details along the way, supported by price-slashed optimism, solid main lender to purchase and you will strong Asian requests.

- Trump’s proposed tariffs and you will rigorous immigration plan “are inflationary in nature,” ING told you, and could result in tighter monetary policy from the Fed.

- However, very moves confidence the You Dollars (USD) acts since the resource is cost in the bucks (XAU/USD).

- The brand new recent Government Set-aside statements to hold rates steady from the minute and reduce prices double this year have raised hopes for interest decrease towards the end of the year, which has sustained silver rates.

- Industrial gold and silver coins such as copper have likewise did robustly, indicating broad-centered product strength inspired by request out of clean times transitions.

- Timber told you he’s optimistic for the Uzbekistan’s currency while the country is both a major bullion music producer and holds generous supplies.

What’s unfolding is over a short-identity field rise—they represents a further realignment out of just how worth and balances try sensed inside the a years of monetary volatility. Extent you purchase silver depends on your overall financing requirements. We recommend dealing with a money elite for investment guidance. Gold or any other gold and silver will be a method to diversify your own profile. Jewelry demand, which comprises regarding the 40% away from worldwide gold usage, can get refuse on account of checklist-higher rates. Asia, the country’s second-biggest nation inside the gold precious jewelry demand, is going thanks to a temporary softer spot within the economic development.